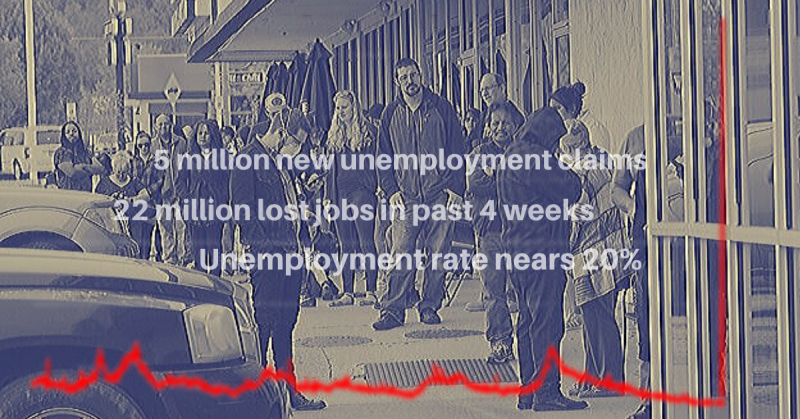

More than 5 million new claims for unemployment

Unemployment rate heading to 20% in April

San José, CA – On Thursday, April 16, the U.S. Department of Labor released their latest report on new claims for unemployment insurance, or UI, benefits showing 5.2 million more people applied. This means that more than 22 million people have lost their livelihood in the last four weeks. The number of people actually collecting unemployment insurance benefits soared to 12 million, the highest ever.

While the number of new applications did fall by about 1 million from the previous two weeks, the current figure still understates the number of people who lost their jobs and weren’t able to file, as states still scramble to fill the demand for claims. Adding these 5 million people to the unemployment rate would push the rate of close to 18%. Even this is an understatement, as most of the people who lost their jobs in early March did not look for work and were not counted as unemployed. Adding another million more people and those who have not been able to apply yet means that the unemployment rate was close to 20% by mid-April.

The continuing near-record level of unemployment insurance numbers show that the first wave of layoffs were in travel and leisure, and the second wave of workers included those whose businesses had to close down, followed by a third wave of workers, including many who can work at home, whose businesses are cutting back as their sales tank.

In addition to millions of renters not being able to pay rent in April, millions of home buyers are missing their mortgage payments. Over the last month, the percentage of home mortgages which are at least 30 days late has soared from 0.2% to 3.7%. While the recent Federal CARES act (which included bail-out money for big businesses, loans to small businesses, increased unemployment insurance payments, and individual relief checks) allows for federal agency mortgages to be deferred, only about half of all mortgages are covered.

More signs of economic crisis came in a report indicating that starts on the construction of new homes fell 22.3% in March as compared to February. This is the largest one-month decline since 1984. Following up on the record decline of manufacturing in New York, today the Philadelphia Federal Reserve said that their index of manufacturing fell from -12.7 to -56.6 in April. New orders fell even more, pointing to even worse conditions in the future.

City, county, and state governments are also under strain. Almost 90% of these local governments have seen their revenues from income and sales taxes fall, and more than half are planning cuts. One of the hardest hit is New York City, the epicenter of the pandemic in the United States. The city government is already planning $3.5 billion less spending the current year.

While Democrats in Congress want to add more aid to local governments in the next pandemic relief bill, Republicans in the Senate and President Trump want to limit the aid to more money for small businesses, as the relief loan program is almost out of money in only two weeks. While Democrats agree to more small business loans, Trump and his followers are sticking to a familiar “my way or the highway,” holding up all the aid.

But despite all of this dismal economic news and the prospect of gridlock on badly needed federal aid, Wall Street managed to eke out a small gain across all the major stock market indices. This is the fourth week in a row where more pain for workers meant more gains for Wall Street.

#SanJoséCA #PoorPeoplesMovements #US #Healthcare #PeoplesStruggles #stockMarket #DonaldTrump #COVID19 #UnemploymentBenefits